This question is always there when it comes to sharing bank statements online. How to ensure the safety of your bank statements? However, with the frequent instances of cyber frauds out there, you should always keep in mind the safety of your banking details while filling forms online. Hence, these are the reasons why any lending institution will ask for your bank statement. Any existing ongoing loan will reduce your chances or will make you ineligible for an instant loan.

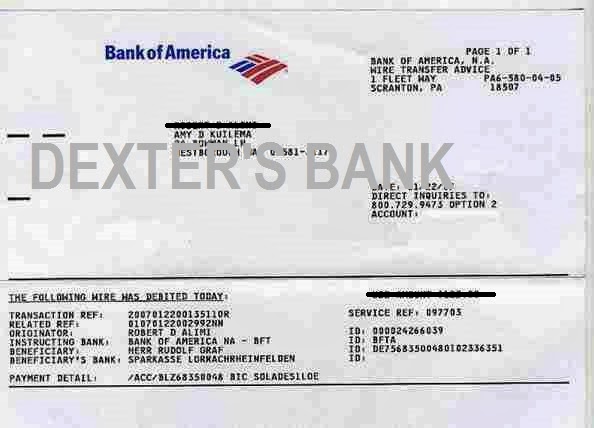

If you are applying for loans, then the most crucial document you need to submit is your bank statement, typically for the past 6 months. The queries around online Instant loan apps are often all related to safety concerns about submitting bank statements. This increase in cyber fraud has created a strong sense of fear among individuals, even if it’s legitimate loaning companies such as EarlySalary. Online banking is great, but it has also contributed to an increase in the number of cyber frauds such as credit card frauds, e-money laundering, spamming, spoofing, phishing, identity theft, etc.

The question is, how do you know whether submitting bank statements is safe and not prone to cyber fraud? Most of us are hesitant before submitting our banking details due to the steep rise in cyberbanking scams over the last few years. For instance, you have to submit bank statements to a company for an instant loan. There’s plenty of instances in life where you might encounter a situation that requires you to submit your bank statements.

But the question is, can submitting personal banking statements lead to cyber fraud? Highlight: Cyber frauds are steadily increasing thanks to a majority of people shifting to online banking.

0 kommentar(er)

0 kommentar(er)